Ensuring students have exposure to and develop knowledge and understanding of basic financial matters, which will equip them to become active and informed citizens.

The Commerce Department at Mount Roskill Grammar School offers a compulsory Financial Education programme for one term to all Year 9 students. This ensures every junior student has exposure to and develops knowledge and understanding of basic financial matters, which will equip them to become active and informed citizens.

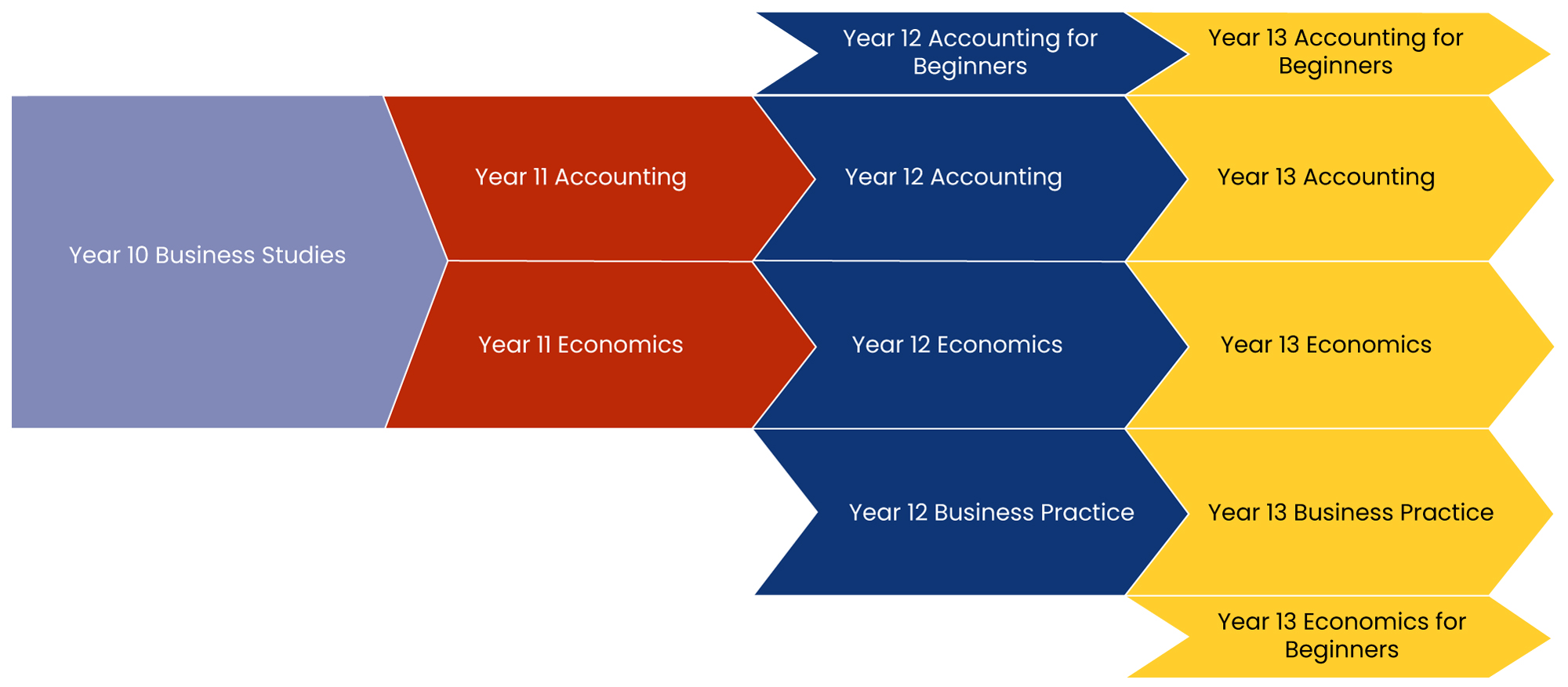

In Year 10, students can select to study a half-year course in Business Studies that builds on the knowledge gained in Year 9 and incorporates these principles in both an individual and business context. This course will also provide an introduction to Accounting and Economic concepts and practices studied in either of these NCEA course pathways.

A school background in Accounting is useful for any person wishing to enter the world of commerce in such areas as business management, risk management, venture capitalists, banking, tourism, marketing, insurance, information technology, resource management, finance, consultancy, advisory and self-employment.

Accounting is a core subject for almost every commerce degree in Australasia and is seen as advantageous for all university graduates- despite specialisation. If a student wishes to be successful – be it in science, medicine, law or commerce, eventually they will be responsible for the management of money by way of budgets and strategic decision-making. Accounting prepares students to handle these funds in a responsible and accurate manner.

Economics is a social science involving the study of people and their activities relating to production, consumption and exchange. The study covers the behaviour of individuals, their work decisions of what to produce, where to locate and how to market, and the activities of Government. A thorough study is also made of major economic issues, i.e. unemployment, inflation, budget deficits, trade imbalances and economic growth.

Economics can be studied as a main or as a supporting subject within either an Arts or a Commerce qualification. Economics also forms a core component of many other qualifications, including Agriculture/Horticulture, through to Parks, Recreation and Tourism Management.

This is a life skill, which is essential for the wellbeing of individuals in our communities.

Courses and Pathways

Year 10 Business Studies

Year 11 Accounting

Year 11 Economics

Year 12 Accounting for Beginners

Year 12 Accounting

Year 12 Business Practice

Year 12 Economics

Year 13 Accounting

Year 13 Accounting for Beginners

Year 13 Business Practice

Year 13 Economics

Year 13 Economics for Beginners

Year 10 Business Studies

Year 10 Business Studies

Entry Requirements:

N/A

Credits:

N/A

BYOD Recommendations:

N/A

Who is this course for?

This course builds on the knowledge gained in Year 9 Financial Education and incorporates these principles in both an individual and business context. This course will also provide an introduction to Accounting and Economic concepts and practices studied in these NCEA Level One subjects.

Year 11 Accounting

Year 11 Accounting

Entry Requirements:

N/A

Credits:

20 Credits at Level 1

BYOD Recommendations:

N/A

Who is this course for?

This introductory Accounting course will provide students with a range of skills to understand basic Accounting information as an individual or owner of a business.

Achievement Standards:

AS 90976 1.1 Demonstrate understanding of accounting concepts for small entities EXT

AS 90977 1.2 Process financial transactions for a small entity INT

AS 90978 1.3 Prepare financial statements for sole proprietors EXT

AS 90981 1.6 Make a financial decision for an individual or group INT

AS 90982 1.7 Demonstrate understanding of cash management for a small entity INT

Year 11 Economics

Year 11 Economics

Entry Requirements:

N/A

Credits:

19 Credits at Level 1

BYOD Recommendations:

N/A

Who is this course for?

This introductory Economics course will provide students with an insight into the ways consumers, producers and the government operate in our economy and is useful in understanding newspaper and television reports on current economic issues

Achievement Standards:

AS 90983 1.1 Demonstrate understanding of consumer choices, using scarcity and/or demand EXT

AS 90984 1.2 Demonstrate understanding of decisions a producer makes about production. INT

AS 90985 1.3 Demonstrate understanding of producer choices using supply. EXT

AS 90987 1.5 Demonstrate understanding of a government choice where affected groups have different viewpoints INT

AS 90988 1.6 Demonstrate understanding of the interdependence of sectors of the New Zealand economy. INT

Year 12 Accounting for Beginners

Year 12 Accounting for Beginners

Entry Requirements:

N/A

Credits:

9 Credits at Level 2 and 8 Credits at Level 1

BYOD Recommendations:

N/A

Who is this course for?

This introductory Accounting course will provide Year 12 students who have not studied Level One Accounting with a range of skills to understand basic Accounting information. The successful completion of this course will allow students direct entry into Level Three Accounting the following year.

Achievement Standards:

AS 90976 1.1 Demonstrate understanding of accounting concepts for small entities EXT

AS 90977 1.2 Process financial transactions for a small entity INT

AS 91175 2.2 Demonstrate understanding of accounting processing using accounting software. INT

AS 91176 2.3 Prepare financial information for an entity that operates accounting subsystems. EXT

Year 12 Accounting

Year 12 Accounting

Entry Requirements:

10 Level 1 Accounting credits including AS90976 or AS 90978.

Credits:

19 Credits at Level 2

BYOD Recommendations:

N/A

Who is this course for?

This course provides students with an opportunity to build on the skills developed in Year 11 Accounting and will introduce new skills such as Accounting for GST and computer processing using accounting software.

Achievement Standards:

AS 91174 2.1 Demonstrate understanding of accounting concepts for an entity that operates accounting subsystems EXT

AS 91175 2.2 Demonstrate understanding of accounting processing using accounting software. INT

AS 91176 2.3 Prepare financial information for an entity that operates accounting subsystems. EXT

AS 91177 2.4 Interpret accounting information for entities that operate accounting subsystems. EXT

AS 91386 2.7 Demonstrate understanding of an inventory subsystem for an entity INT

Year 12 Business Practice

Year 12 Business Practice

Entry Requirements:

Level 1 Literacy

Credits:

19 Credits at Level 2

BYOD Recommendations:

N/A

Who is this course for?

This course teaches students the fundamental skills of business practice which include processing cash transactions and office administration procedures that are useful for students seeking employment opportunities in an office environment. If students take this course in conjunction with Year 12 Computing Skills, they can gain credits towards the National Certificate in Computing and Business Administration, as well as NCEA.

Achievement Standards:

US 64 Perform calculations for the workplace INT

US 107 Apply text processing skills to produce communications in a business or organisation context INT

US 111 Use a word processor to produce documents for a business or organisation INT

US 121 Demonstrate and apply knowledge of Office Equipment and Administration processes INT

US 327 Document business financial transactions for an entity. INT

US 497 Demonstrate knowledge of workplace health and safety requirements. INT

Year 12 Economics

Year 12 Economics

Entry Requirements:

Level 1 Literacy

Credits:

22 Credits at Level 2

BYOD Recommendations:

Laptop

Who is this course for?

Using economic models and graphs, this course requires students to study in-depth Government Policies around key economic issues of Growth, Trade, Inflation and Unemployment

Achievement Standards:

AS 91222 2.1 Analyse inflation using economic concepts and models EXT

AS 91224 2.3 Analyse economic growth using economic concepts and models EXT

AS 91225 2.4 Analyse unemployment using economic concepts and models INT

AS 91227 2.6 Analyse how government policies and contemporary economic issues interact INT

Year 13 Accounting

Year 13 Accounting

Entry Requirements:

12 Level 2 Accounting credits including AS91174 or AS 91176

Credits:

22 Credits at level 3

BYOD Recommendations:

N/A

Who is this course for?

This course builds on studies offered at earlier levels of Accounting as well as introducing new skills to understand both the operations of and accounting for partnerships, companies and manufacturing enterprises.

Achievement Standards:

AS 91404 3.1 Demonstrate understanding of accounting concepts for a New Zealand reporting entity EXT

AS 91405 3.2 Demonstrate understanding of accounting for partnerships INT

AS 91406 3.3 Demonstrate understanding of company financial statement preparation EXT

AS 91407 3.4 Prepare a report for an external user that interprets the annual report of a New Zealand reporting entity INT

AS 91409 3.6 Demonstrate understanding of a job cost subsystem for an entity INT

Year 13 Accounting for Beginners

Year 13 Accounting for Beginners

Entry Requirements:

Year 13 students undertaking an NCEA Level 3 Achievement Standard Course of study and do not need to have previously studied Accounting.

Credits:

18 Credits at Level 3

BYOD Recommendations:

N/A

Who is this course for?

This course introduces fundamental Accounting practices and applies these new skills to gain an understanding of partnerships, companies and manufacturing enterprises enabling students to successfully gain Level 3 Accounting credits.

Achievement Standards:

AS 91099 2.2 Analyse specified aspect(s) of visual or oral text(s) supported by evidence EXT

AS 91105 2.8 Use information literacy skills to form developed conclusion(s) INT

AS 91106 2.9 Form developed personal responses to independently read texts supported by evidence INT

Level 2 US 3488 Write a business correspondence for a workplace INT

Year 13 Business Practice

Year 13 Business Practice

Entry Requirements:

Level 1 Literacy

Credits:

21 Credits at Level 3

BYOD Recommendations:

N/A

Who is this course for?

This course teaches students advanced fundamental skills of business practice which include the general requirements of financial records and using accounts receivable and payable systems that are useful for students seeking employment opportunities in an office environment.

Achievement Standards:

US 108 Apply text processing skills to produce business documents. INT

US 112 Produce business or organisational information using word processing functions. INT

US 328 Identify the requirements for a financial record system for an entity INT

US 26768 Use a computerised accounts receivable and payable system to produce financial information. INT

Year 13 Economics

Year 13 Economics

Entry Requirements:

12 Level 2 Economics credits

Credits:

18 Credits at level 3

BYOD Recommendations:

N/A

Who is this course for?

This course will focus on the efficiency of firms’ output/ pricing decisions, the efficiency of individual commodity markets and also when government intervention is required to improve our economy‘s performance.

Achievement Standards:

AS 91399 3.1 Demonstrate understanding of the efficiency of market equilibrium. EXT

AS 91400 3.2 Demonstrate understanding of the efficiency of different market structures using marginal analysis EXT

AS 91401 3.3 Demonstrate understanding of micro-economic concepts INT

AS 91402 3.4 Demonstrate understanding of government interventions to correct market failures INT

Year 13 Economics for Beginners

Year 13 Economics for Beginners

Entry Requirements:

Year 13 students undertaking an NCEA Level 3 Achievement Standard Course of Study and do not need to have previously studied Economics.

Credits:

Up to 18 Credits at Level 3

BYOD Recommendations:

N/A

Who is this course for?

This course introduces fundamental Economic concepts and applies these skills to both New Zealand and world economies enabling students to successfully gain Level 3 Economics credits.

Achievement Standards:

AS 91399 3.1 Demonstrate understanding of the efficiency of market equilibrium. EXT

AS 91400 3.2 Demonstrate understanding of the efficiency of different market structures using marginal analysis EXT

AS 91401 3.3 Demonstrate understanding of micro-economic concepts INT

AS 91402 3.4 Demonstrate understanding of government interventions to correct market failures INT

Gunjan Soeny

Subject I have taken: I am studying commerce, which consists of two separate subjects: accounting and economics.

Why am I studying this subject: I am studying both commerce subjects as I am genuinely interested in them and have been ever since I started high school. Year 9 business studies is what sparked my interest in commerce and over the years this interest has grown. As a result I am now planning on pursuing a career in commerce and law at Auckland university.

What this subject offers me: These subjects have built me a strong foundation that I can base my future studies on, as they are giving me the knowledge to evaluate and calculate financial information, and have given me an insight on how to objectively see economic situations that I can provide reports and research around. I have improved many of my skills and have gained tremendous knowledge of the economical and financial world around us.

What I love about this subject: I love how supportive this department is. Over the past four years I have been constantly supported and mentored by the staff of the commerce department to such an extent that I tend to go to them for non topic related queries too. I like how organised and time efficient our classes are, we complete all our internal related subjects by term 2, giving us plenty of time to learn and revise for exams. All the teachers in this department are very helpful by making the subjects easy to understand, and go out of their way to provide us students with all the resources to make even the most challenging of topics easier.